The Year's Biggest New-Car Winners And Losers

The auto industry rides into the 2018 model year in what seems to be a state of extreme flux.

Khodrocar - Those economical small cars that

consumers snapped up in earnest a few years ago when gas prices were

pushing the $4.00-a-gallon mark have become the albatrosses hanging

heavy around the necks of new-car dealers. And yet, electric car sales

are up by 36.6% so far this year, compared to the same period in 2016,

so go figure.

Here, by segment, are the winners and sales laggards among passenger cars over the first 10 months of 2017, based on year-over-year-to-date data provided by Kelley Blue Book and confirmed via automakers’ reports (for our purposes here we aren’t counting models that were discontinued or phased out earlier in the year, or were introduced for 2017 and had no prior sales history). We’ll highlight the SUVs, trucks, and minivans showing the biggest jumps and sales dips in a separate post.

Subcompact Cars

Consider this the island of misfit autos this year, registering the largest sales drop thus far among all new-car segments at an average 16.4%. Renamed the Toyota Yaris iA for 2017, the small sedan formerly known as the Scion iA was one of the only models to see an increase, which amounts to a healthy 28.7% boost. Meanwhile, sales of the Kia Rio slid by 47.6% as it falls into a full redesign for 2018.

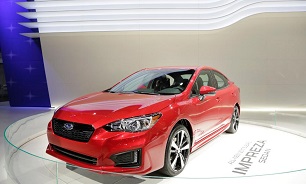

Compact Cars

With the compact-car segment already down by 5.3% over the first 10 months of 2017, sales increases are hard to come by, though the Subaru Impreza is enjoying a stellar 48.3% boost in deliveries. At the other end of the spectrum, the Hyundai Veloster coupe lost 52.9% of sales through the end of October.

Midsize Cars

The industry sold 15.6% fewer midsize models over the first 10 months of the year, with all models showing losses. The winner here, if you can call it that, is the Honda Accord which, despite a major 2018 revision looming, lost only 2.3% of sales; the Volkswagen CC, by comparison, lost 52.2% of its volume.

Full-Size Cars

With sales in this segment down by 11.6% on the year, only the Nissan Maxima (+5.9%) and, surprisingly, the Kia Cadenza (+35.2%) showed growth. Being discontinued at the end of the 2017 model year, and perhaps with dealer minimized in anticipation, Hyundai Azera sales sank by 32.9%.

Entry-Level Luxury Cars

Sales are off by 10.7% for 2017 here, as upscale consumers continue to make the switch to crossover SUVs. Still, the Infiniti Q60 registered a whopping 324.0% jump based on sales of 9,065 units. With the midsize Buick Regal facing a major 2018 redesign, its deliveries have fallen by 41.8% this year.

Luxury Cars

The upscale sedan segment is flat so far this year, with recently introduced models with little sales history (like the Lincoln Continental, Genesis G90, and Volvo S90) showing major increases. Otherwise, the winner here is the Audi Allroad wagon with a 50.3% increase (with 2,582 units sold), and the big loser being the Lexus GS, with a 50.5% loss on the year.

High-End Luxury Cars

Sales of the industry’s flagship sedans are slipping almost across the board, with upscale SUVs picking up the slack. The Porsche Panamera is the lone winner here with a 52.6% sales boost; the Mercedes-Benz CLS is headed in the other direction fast with a 59.3% loss.

Sports Cars

While the Ford Mustang still leads this segment over the first 10 months of the year, the Pony Car’s sales are down by 27.2%. The Mazda MX-5 Miata, feeling the results of a 2017 redesign, is up by 23.6%, though its 10,314 deliveries still fall far short of the Mustang’s 67,482 units.

High-Performance Cars

Aside from the new-for-2017 Acura NSX’s 194.7% sales jump (which amounts to 442 sales), the Audi R8 wins the segment with a 14.6% increase, while sales of the venerable Chevrolet Corvette sank by 20.2%.

Hybrid/Alternative Energy Vehicles

With the segment seeing a modest 3.6% increase over the first 10 months of the year, the big winner by sales percentage is the Toyota Mirai with a 59% boost, though that only accounts for 2017 sales of 1,293 units. The Toyota Prius still rules the roost, outselling all other models combined, though its sales are off by 19.9% this year. Being discontinued for 2018, the Lexus CT is the biggest loser here, finishes its final model year with a 36.7% dip.

Electric Vehicles

Sales are up by more than a third on the year here, buoyed by the now segment-leading Chevrolet Bolt, which recently stole the lead over its showroom sibling, the Volt. The swoopy and expensive BMW i8 suffers the biggest 2017 loss to date here with a 71.7% plunge.

Here, by segment, are the winners and sales laggards among passenger cars over the first 10 months of 2017, based on year-over-year-to-date data provided by Kelley Blue Book and confirmed via automakers’ reports (for our purposes here we aren’t counting models that were discontinued or phased out earlier in the year, or were introduced for 2017 and had no prior sales history). We’ll highlight the SUVs, trucks, and minivans showing the biggest jumps and sales dips in a separate post.

Subcompact Cars

Consider this the island of misfit autos this year, registering the largest sales drop thus far among all new-car segments at an average 16.4%. Renamed the Toyota Yaris iA for 2017, the small sedan formerly known as the Scion iA was one of the only models to see an increase, which amounts to a healthy 28.7% boost. Meanwhile, sales of the Kia Rio slid by 47.6% as it falls into a full redesign for 2018.

Compact Cars

With the compact-car segment already down by 5.3% over the first 10 months of 2017, sales increases are hard to come by, though the Subaru Impreza is enjoying a stellar 48.3% boost in deliveries. At the other end of the spectrum, the Hyundai Veloster coupe lost 52.9% of sales through the end of October.

Midsize Cars

The industry sold 15.6% fewer midsize models over the first 10 months of the year, with all models showing losses. The winner here, if you can call it that, is the Honda Accord which, despite a major 2018 revision looming, lost only 2.3% of sales; the Volkswagen CC, by comparison, lost 52.2% of its volume.

Full-Size Cars

With sales in this segment down by 11.6% on the year, only the Nissan Maxima (+5.9%) and, surprisingly, the Kia Cadenza (+35.2%) showed growth. Being discontinued at the end of the 2017 model year, and perhaps with dealer minimized in anticipation, Hyundai Azera sales sank by 32.9%.

Entry-Level Luxury Cars

Sales are off by 10.7% for 2017 here, as upscale consumers continue to make the switch to crossover SUVs. Still, the Infiniti Q60 registered a whopping 324.0% jump based on sales of 9,065 units. With the midsize Buick Regal facing a major 2018 redesign, its deliveries have fallen by 41.8% this year.

Luxury Cars

The upscale sedan segment is flat so far this year, with recently introduced models with little sales history (like the Lincoln Continental, Genesis G90, and Volvo S90) showing major increases. Otherwise, the winner here is the Audi Allroad wagon with a 50.3% increase (with 2,582 units sold), and the big loser being the Lexus GS, with a 50.5% loss on the year.

High-End Luxury Cars

Sales of the industry’s flagship sedans are slipping almost across the board, with upscale SUVs picking up the slack. The Porsche Panamera is the lone winner here with a 52.6% sales boost; the Mercedes-Benz CLS is headed in the other direction fast with a 59.3% loss.

Sports Cars

While the Ford Mustang still leads this segment over the first 10 months of the year, the Pony Car’s sales are down by 27.2%. The Mazda MX-5 Miata, feeling the results of a 2017 redesign, is up by 23.6%, though its 10,314 deliveries still fall far short of the Mustang’s 67,482 units.

High-Performance Cars

Aside from the new-for-2017 Acura NSX’s 194.7% sales jump (which amounts to 442 sales), the Audi R8 wins the segment with a 14.6% increase, while sales of the venerable Chevrolet Corvette sank by 20.2%.

Hybrid/Alternative Energy Vehicles

With the segment seeing a modest 3.6% increase over the first 10 months of the year, the big winner by sales percentage is the Toyota Mirai with a 59% boost, though that only accounts for 2017 sales of 1,293 units. The Toyota Prius still rules the roost, outselling all other models combined, though its sales are off by 19.9% this year. Being discontinued for 2018, the Lexus CT is the biggest loser here, finishes its final model year with a 36.7% dip.

Electric Vehicles

Sales are up by more than a third on the year here, buoyed by the now segment-leading Chevrolet Bolt, which recently stole the lead over its showroom sibling, the Volt. The swoopy and expensive BMW i8 suffers the biggest 2017 loss to date here with a 71.7% plunge.

Latest News